How To Sell Your House Fast in Pembroke Pines Florida

This detailed guide will show you how to sell your house fast in Pembroke Pines Florida. We'll cover pricing strategies, preparing your house for showing appointments and finding the right real estate agent.

|

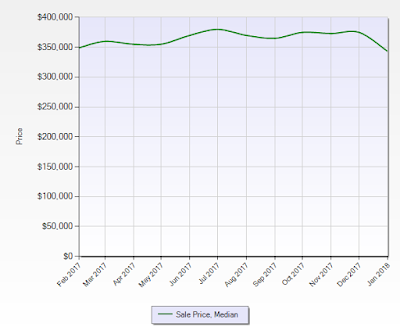

| Days On The Market VS. List Price |

If you want to know your home's value in today's Pembroke Pines real estate market call Priscilla at 305-783-4269.

Simple Pricing Strategies To Move Your Home Fast

The main key to successfully selling your home is to list your home at the right price. You have some pricing flexibility if your mortgage is paid off or paid down. If your mortgage is still on the high side you're forced to list your price for at least your payoff amount, if the market prices are at those levels, if the market trends are not high enough to meet your mortgage payoff amount then you'd need to consider selling your home as a short sale.

You have to realize that you can't price it for "x" amount just because that's what you paid for it, the Florida real estate market prices go up and down. You can't sell it for the price you paid for it combined together with the price of all the improvements you've put into it or work you've had done on it. You can't price it at the same price as your neighbors' homes. In most instances, you will only get a buyer if it's priced at what the buyer is willing to pay for your home.

The way to find the "golden" price to list your home at is to research the recent sales in your area. You want to search within a 1/4 mile radius of your house, same number of bedrooms, same number of bathrooms, same number of half bathrooms, same house style, same year built and same square footage sold within the last 90 days. Select 5 homes that are most similar to yours, these will be your comparables. Add those sales prices together and divide them by 5, that's an average price of what your home is worth today.

Depending on the value you arrived at by using the above search criteria, list your home's price about $5,000 or more lower than that figure. Now you're probably asking yourself why I said list your house for sale at a lower price, because you want multiple offers and the competitive pricing strategy is the best way to get a lot of action fast on your house. You don't want just 1 offer, you want multiple offers just in case one of the buyers fall through and so they will have a bidding war on your home to outbid each other. Keep in mind this section is about how to sell your house quickly so you'd want to take the steps listed here to do that.

Another method is to use the same search criteria as above and divide the price the house sold for by the square feet of the house. Do this for all of the five comparable homes separately and add the total and then divide it by 5 to get the sold price per square foot. Multiply that number by the number of square feet in your home and that's your proper list price.

You could pay an appraiser for an appraisal if you don't want to do it yourself.

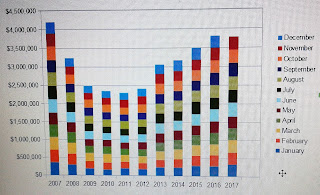

|

| Original List Price VS. Sales Price |

Preparing Your Home For Showing Appointments

Since you're selling your home we're going to assume that you'll be moving out of it, get ready for that now. What I mean by that is either pack up everything and put it in a storage facility or get a portable storage unit to put all of your belongings in.

You want to take everything of value and all of your photos, knick-knacks, pictures, decorative items, your furniture if it's outdated, your out of season clothes (if it's summertime, put the fall, spring and winter clothes in the storage unit), your linens, your dishes, etc. I don't mean everything but almost everything and definitely everything that makes the home look cluttered.

Nothing looks worse than a beautiful home with clutter that's blocking the true beauty and everyone has different tastes so to appeal to the masses, you MUST do this. Learn how to live like a minimalist temporarily, it'll payoff in the end.

Spring clean your whole house, clean the walls, baseboards, windows, carpet, flooring. You want to clean it so well that it looks like a brand new house, that's what it will be to your buyer.

You've been living comfortably in your house for years with all of your decorations and additions that you love so you're used to looking at everything in your home and you like it. Since you want to sell your house, it no longer matters whether it appeals to you or not.

You need "virgin" eyes to look at your home to give you tips on what to remove to make it more appealing. By virgin eyes I mean someone who's never been inside your home that will give you an honest opinion of your home. You wouldn't be the best judge of that because you're used to it.

Just prior to a showing pour about 3 cups of water and 1/4th cup of Fabuloso into a pot and bring it to a boil and then you'll want to reduce it to simmer immediately. If you leave it boiling too long it'll emit a burnt smell. This will give your home a nice fresh and clean smell and will eliminate any odors present in your home that you've gone "nose-blind" to such as pets, food smells, cigarettes, pipes, etc. It even eliminates the smell of fried fish and we all know how strong those odors can be. Do not use potpourri or air fresheners with food scents like apple pie, cinnamon or vanilla, a fresh and clean scent is always the best.

Fold your towels and toilet paper like the hotels do, that's always more appealing than just having them hang there.

Open all the curtains and blinds to make your house as bright and sunny as possible.

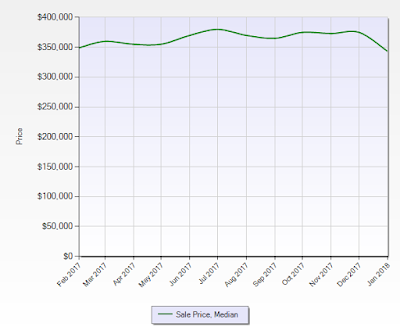

|

| Sales Price Trends Last 12 Months |

Finding The Right Real Estate Agent

We were all born with the perfect "phony" radar which is our gut instinct. If you meet with a Real Estate Agent and something doesn't feel right, go with your gut instinct and move on to the next one. On the other hand I'd say that if you feel that way towards all of the Agents you interview with, the possibility exists that you're not ready to sell your home or that you don't want to sell your home.

There's no rule that says you have to select someone who's been an Agent for 30 years, these days newer could mean fresher with more up to date marketing techniques. If you do interview someone who's had their license for less than a year verify with them that they have a superb support system at their brokerage or a mentor that can help them with any questions if you're leaning towards selecting them as your Listing Agent. Newbies can be okay as long as they have some help when they need it.

Everyone you're interviewing should come prepared with a comparative market analysis also known as a CMA in the real estate industry. If they didn't, they're not genuinely serious about helping you and won't be prepared for other important issues during the transaction.

This is the number one tool they need to list your house at the right price and if they didn't do that then it's highly likely that they won't do anything else right.

Never ever ever select a Real Estate Agent as your Listing Agent if they seem timid, shy or if they agree with everything you say.

You're choosing someone who's supposed to be negotiating contracts for the sell of (most likely) your biggest asset and you don't want someone who'll back down at the first sign of confrontation. What kind of negotiating would they really be able to do???

We all have our professions for a reason and we use different professionals for whatever their specialty is.

The Agent you're interviewing should be able to answer instantaneously when you ask them what their number 1 selling tool is. If they can't then either they're not selling any homes, they're trying to figure out what answer you want to hear, they're not doing their own marketing or they haven' t researched their numbers to figure out what works best. In either instance you don't want them as your Agent.

#HowToSellYourHouseFast

#SimplePricingStrategiesToMoveYourHomeFast

#PreparingYourHomeForShowingAppointments

#FindingTheRightRealEstateAgent

#SellingAHome